vermont sales tax exemptions

For more information contact the Vermont Department of Motor Vehicles. Historically Total Tax Exemptions for Vermont reached a record high of 58912600000 in January of 2007 and a record low of 49139400000 in January of 1990.

Total Tax Exemptions for Vermont was 54315100000 Number of Exemptions in January of 2019 according to the United States Federal Reserve.

. Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines. A SmartSave energy specialist performs an in-depth study at the business location to determine the exact proportion of energy use that is exempt from taxation. The maximum local tax rate allowed by Vermont law is 1.

Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. The production and use of compost products. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax.

You will be required to prove that the vehicle was registered in a qualifying jurisdiction for at least 3 years. Everything you need to know about collecting Vermont sales tax. Retail sales and use of the following shall be exempt from the tax on retail sales imposed under section 9771 of this title and the use tax imposed under section 9773 of this title.

For the 2020 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. The law requires the seller to collect and remit sales tax on retail sales of tangible personal property and certain services. Sales of tangible personal property.

All other veterans are not exempt including veterans who may be 100 disabled. There are 46 exemptions from the Sales and Use Tax including clothing and food. Charge the tax rate of the buyers address as thats the destination of your product or service.

This website uses cookies. 1 Sales not within the taxing power of. Vermonts state-wide sales tax rate is 6 at the time of this articles writing with local option taxes potentially adding on to that.

Department of Motor Vehicles -. Vermonts sales tax laws include. In Vermont certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Prepared foods restaurant meals and housing are subject to a 9 state sales tax while alcoholic beverages sold in restaurants are subject to a 10 tax. The state-wide sales tax in Vermont is 6. The Vermont Sales and Use Tax is imposed on the exempted by law.

You may claim a tax credit for a vehicle registered to you for a period of 3 years or more in a jurisdiction that imposes a state sales or use tax on vehicles. Since sales tax rates may change we advise you to check out the Vermont Department of Taxes Tax Rate page which has the current rate and links to lookup specific municipal rates. Maintaining and tracking all of the subtleties in the state sales tax code is a nightmare for businesses.

There are additional levels of sales tax at local jurisdictions too. The compost tax issue emerged when changes to the tax code in 2007 omitted compost and planting mixes from the list of products exempt from sales tax when used in farming. Vermont sales tax applies to the transfer of taxable tangible goods and services.

Testimony from the Tax Department identified other inconsistencies and inequities regarding tax code for inputs to grow food. 53 rows Exemption extends to sales tax levied on purchases of restaurant meals. Vermonts legislators have enacted sales tax laws usually referred to as tax statutes.

Sales of at least 100000 or 200 individual transactions during any preceding 12 month period Other Marketplace Facilitator Effective June 1 2019. Veterans who meet these criteria are exempt from vehicle sales tax registration fees and license fees. Restaurant meals may also.

Harbor Compliance can obtain Vermont sales tax exemption for your 501c3 nonprofit. Present sales use. Examples of Sales Subject to the Sales and Use Tax.

SmartSave investigates clients current utility situation and quickly identifies if the company is eligible to save on its utility sales tax through the exemption. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0153 for a total of 6153 when combined with the state sales tax. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

Trading Economics provides the current actual value. These exemptions certificates are given to certain types of organizations as well as for specific types of goods including but not. An example of an item that is exempt from Vermont sales tax are items which were specifically purchased for resale.

Submit a completed Certification of Tax Exemption form VT-014 with a completed Registration or Tax Title. We use cookies to personalise content and ads to provide social media features and to analyse our traffic. Sales of public utility services of fuel and electricity.

Also the state publishes rules that define and explain in more detail their tax statutes. Find out when returns are due how to file them and get sales tax rates. Vermont has a destination-based sales tax system so you have to pay attention to the varying tax rates across the state.

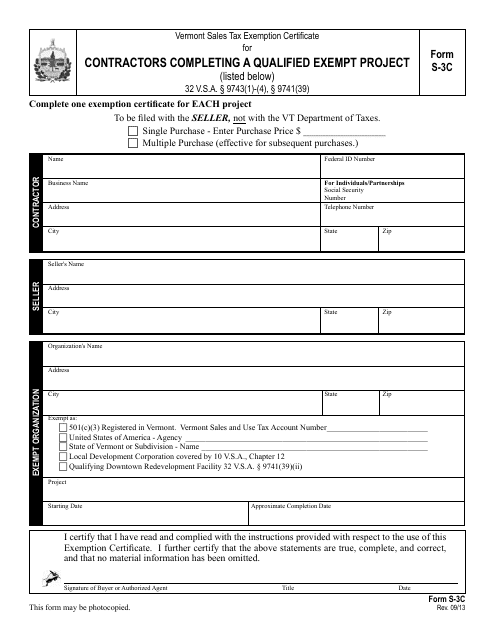

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

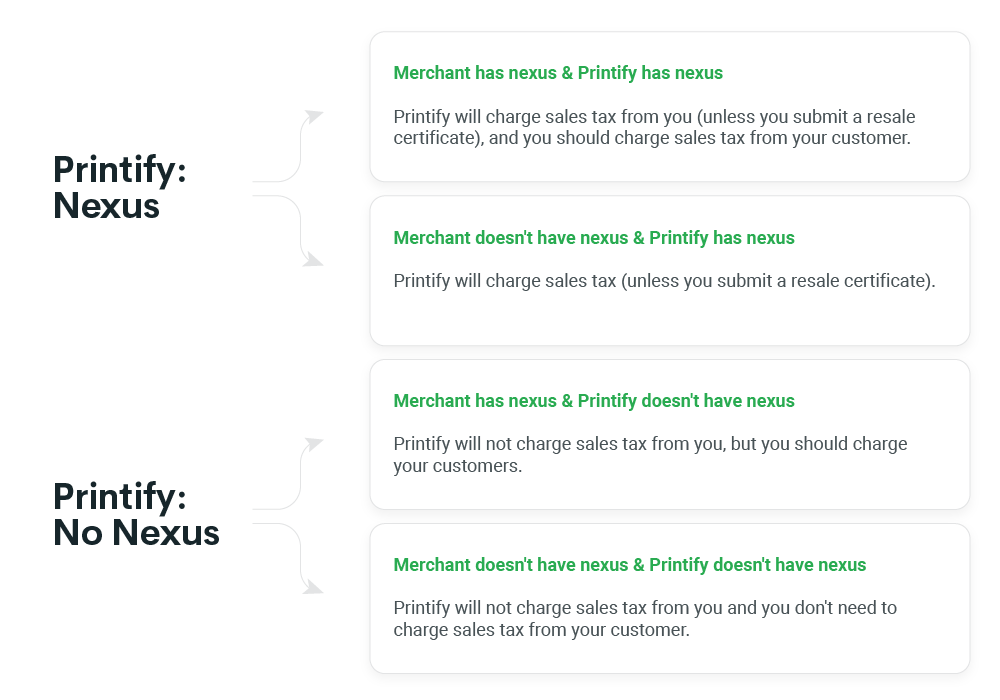

Understanding Sales Tax With Printify Printify

States Without Sales Tax Article

A Complete Guide To Sales Tax Exemptions And Exemption Certificate Management

States With Highest And Lowest Sales Tax Rates

Sales Tax Holidays Politically Expedient But Poor Tax Policy

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

States Without Sales Tax Article

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

States Without Sales Tax Article

Sales Tax By State Is Saas Taxable Taxjar

Map State Sales Taxes And Clothing Exemptions Tax Foundation

What Is Sales Tax A Complete Guide Taxjar

State By State Guide To Taxes On Retirees Retirement Tax States

Push Is On To Expand Vt Sales Tax To Services Ethan Allen Institute